What is Impact Investing?

As the world navigates complex challenges like climate change, social inequality, and environmental degradation, many investors are looking for ways to put their money to work for the greater good.

Enter: Impact investing. Impact investing are investments that allow individuals and organizations to generate a balance of substantial financial returns and positive social or environmental outcomes.

It’s gained significant traction in recent years and continues to climb: impact investing assets under management (AUM) grew by a compound annual growth rate (CAGR) of 18% between 2017 and 2022, and the size of the impact investing market currently stands at USD 1.164 trillion in AUM.

Let’s walk through the world of impact investing, explore its significance, examine its role in food and agriculture, and how venture capital applies to the approach.

Defining Impact Investing

Impact investing is a form of responsible investing that aims to generate positive, measurable social and environmental impacts alongside financial returns. Unlike traditional investments that focus primarily on profit, impact investing is driven by a dual objective: to make money while making a difference.

Investors seek opportunities in emerging and established markets that address pressing global challenges. Think: poverty alleviation, healthcare access, renewable energy, climate change mitigation, sustainable agriculture, renewable energy, accessible basic services (housing, healthcare, and education), and more.

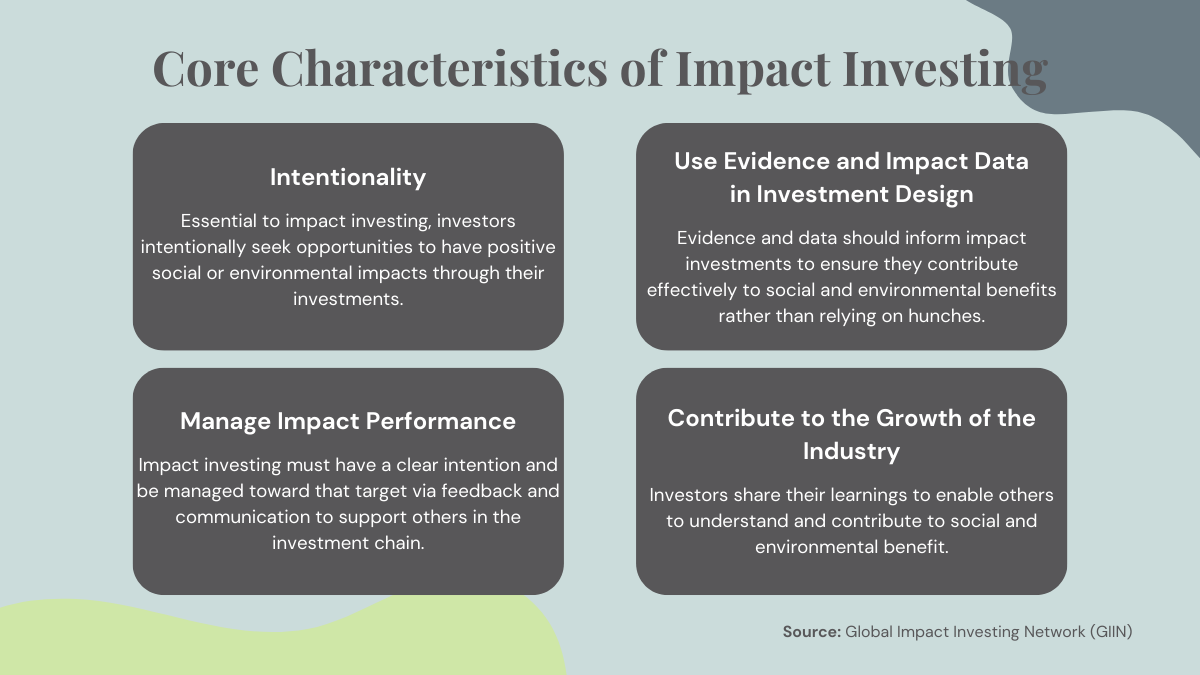

According to the Global Impact Investing Network (GIIN), the core characteristics of impact investing are:

1. Intentionality

Essential to impact investing, investors intentionally seek opportunities to have positive social or environmental impacts through their investments.

2. Use Evidence and Impact Data in Investment Design

Evidence and data should inform impact investments to ensure they contribute effectively to social and environmental benefits rather than relying on hunches.

3. Manage Impact Performance

Impact investing must have a clear intention and be managed toward that target via feedback and communication to support others in the investment chain.

4. Contribute to the Growth of the Industry

Investors share their learnings to enable others to understand and contribute to social and environmental benefit.

Impact investors measure their success not only in dollars but also in terms of their contribution to a better world.

And that’s proving to be favourable as financial and impact returns continuously meet—even exceed—expectations. Numbers from 2023 GIINsight: Impact Investing Allocations, Activity & Performance report share that 79% of impact investors report their financial performance meets or exceeds their targets, and 88% report that impact performance meets or exceeds their impact targets.

Why Impact Investing Matters

With impact investing, we’re seeing a shift in the financial landscape towards a more sustainable and equitable future. Beyond the surface goals, there are several reasons why it’s important:

Attracting innovative solutions

Impact investing encourages innovation by providing capital to ventures dedicated to solving real-world problems. This funding can drive the development of groundbreaking solutions, whether in healthcare, renewable energy, or sustainable agriculture.

Aligning values and wealth

Many investors today are looking for ways to align their personal values with their financial decisions. Impact investing aligns financial goals with ethical values, creating a sense of purpose in investment decisions.

Risk mitigation

Impact investments can reduce risk by promoting long-term sustainability, which can lead to stable returns. Additionally, companies that prioritize environmental and social responsibility are often more resilient, transparent, and better equipped to weather storms.

Market growth

As we know, the impact investing market is expanding rapidly. Reflecting the growing demand for investments that generate both returns and positive outcomes, as more investors recognize the potential of impact investments, the better positioned the market for continued growth and evolution.

Measurable impact

Recall the core characteristics—one of the strengths of impact investing is its focus on measurable results. Investors can track and assess the social and environmental impact of their investments, ensuring transparency and accountability throughout the process.

Food, Agriculture, and Investing for Good

One area in particular we'd like to zoom into is the food and agriculture industry.

With the global population continually on the rise, the demand for sustainable and equitable food production is paramount. Agriculture not only sustains human life and provides economic gains, but it also presents a tremendous opportunity to combat our changing climate. Transforming food systems is a launching pad for the betterment of our planet.

The number of investment funds specialized in the sector is on an upward trend: in 2022, there were 730 investment funds specialized in food and agriculture, compared to fewer than 50 in 2005. While some good movement is happening, there’s still much higher to reach, and given the size of the market, the number of fund managers in this space could be increasing even more rapidly.

Impact investors focused on food and agriculture can invest in a wide range of business opportunities—from precision agriculture to productivity tools, waste reduction to crop management, local solutions to scaleable tech, and everything in between.

Investing in agriculture not only addresses the global need for creating a food secure planet but also preserves it for the next-generation.

The Role of Venture Capital

Venture capital funds are crucial for nurturing early-stage startups with groundbreaking ideas, enabling them to develop and scale their ideas and ultimately deliver measurable environmental and social impacts.

Venture capital in the realm of impact investing is instrumental in catalyzing positive change.

But because the lack of diversity is still prevalent in venture capital—women represent only 26% of the VC workforce, and BIPOC continue to see limited representation—this impacts which companies are funded on the other side of the table. Being underrepresented from the top down means founders less connected to already wealthy communities will tend to know fewer people willing to use their financial and social capital for support.

But when impact investing and a diverse and economic inclusion venture capital strategy intersect, this activates untapped innovation and meets the growing market demand for sustainable investments and capital. Impact investing opens the door for those underrepresented founders that may not have had the connections or access to resources otherwise.

Doing good and doing well do not have to be contradictions. You can have both impact and profit.

With regard to how impact investments perform financially, GIIN explains that impact investors have diverse financial return expectations. “Some intentionally invest for below-market-rate returns, in line with their strategic objectives. Others pursue market-competitive and market-beating returns, sometimes required by fiduciary responsibility. Most investors pursue competitive, market-rate returns.”

The spectrum reflects the diversity of financial goals within the impact investing community, but goes back to the point that you can do good and do well.

Aligning the intention of impact investing to our mission of affording people of underrepresented genders opportunities to learn about and activate their investing and entrepreneurship potential, we’re thrilled to partner with the Small Scale Food Processor Association (SSFPA) on their Venture-Capital Ready: Investment Training for Women Entrepreneurs program.

Venture-Capital Ready is aimed at food industry women/intersectional entrepreneurs ready to present themselves and their business for investment and scale up to meet market demand.

Within the two-year program, M51 is facilitating a four-module investor curriculum to guide participants through the fundamentals of early-stage investing with a focus on impact investing and the Canadian food and agriculture sector.

Keep an eye out on our blog and social media to follow along with the modules and as we share more resources around impact investing, food and agriculture, and building the world we want to live in—today and for future generations.